LATITUDE FINANCIAL SERVICES

Led a design team to evaluate money management tools for the Gem App.

ROLE

Customer Experience Lead

Latitude Financial Services | Melbourne

PROBLEM

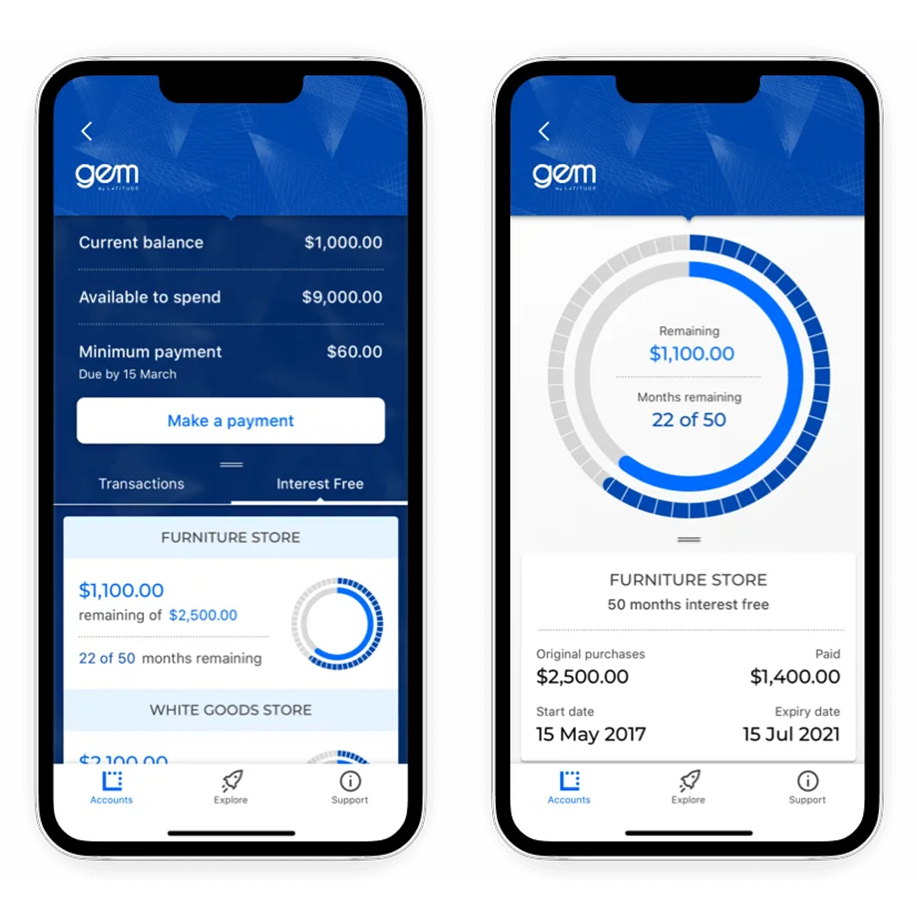

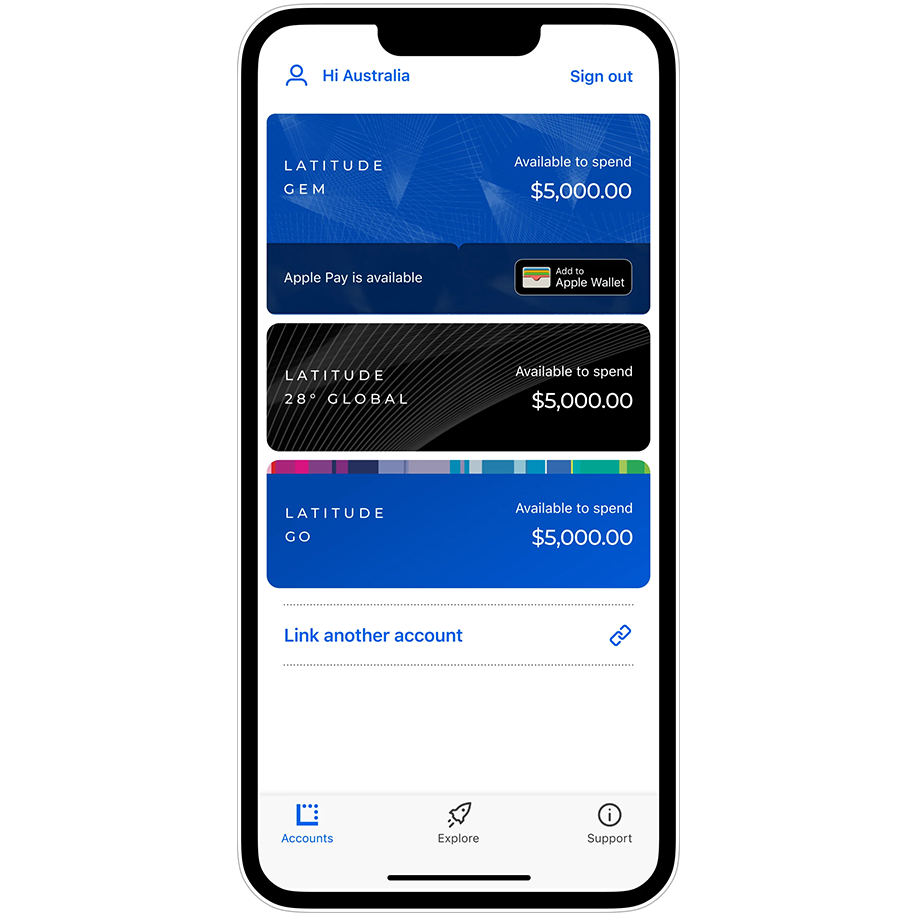

I worked within the customer experience team on 2 key projects: Latitude Money (Personal financial management tools) and Latitude Pay (Buy now, pay later). This case study features Latitude Money.

My initial engagement was for Latitude Money, researching and evaluating a new product offer for Personal Financial Management (PFM) tools in their native app servicing customers with credit cards and personal loans. We worked in 10-day design sprints to research and evaluate PFM features.

The Latitude app did not feature any financial management tooling to support customers expectations for better ways to manage their expenses and repayments. Our task was to evaluate whether to adopt an existing white-label market solution or develop the PFM tools in-house.

APPROACH

We started by researching the business strategy and analysing existing data to understand the products, customer base, and future forecasts. Stakeholder workshops were designed to map digital journeys and explore where PFM features could sit within existing offerings. To uncover customer needs and behaviours, we conducted qualitative interviews, complemented by a competitor analysis to evaluate in-market solutions. Quantitative research was outsourced to gain a broader data set, and we collaborated with a white-label startup to align journeys, research insights, and value propositions, ultimately assessing an integrated digital offering to launch an MVP.

OUTCOME

We validated customer segments, mindsets, and emerging behaviours, identifying options for targeting specific customer cohorts. This work culminated in an insights report outlining key opportunity areas for development and providing strategic partnership recommendations.